Entrepreneur; What Are You Waiting For?™

Useful Forms & Important Issues ...

FREE We are pleased to provide ten of our most requested forms, as a courtesy to you for visiting our website. 1) Affidavit You will need the FREE Acrobat reader to open the above documents. The Most Common Questions We Get What is a Copyright, Patent, and Trademark? What is a Compulsory Mechanical License & the Statutory Rate?

|

The Right to Terminate: a Musicians’ Guide to Copyright Reversion Unlike most countries, the United States copyright law provides musicians and songwriters an opportunity to regain ownership of works that they transferred to outside entities, such as record labels and music publishers. Congress established this “second bite at the apple” for authors of creative works after a period of 35 years. “Termination of transfer” is not automatic, however, and there are certain steps creators must take to regain the rights to their works. This guide aims to shed more light on the process for the benefit of musicians and songwriters who are eligible to reclaim ownership of their creations. As you read this guide, it is important to keep in mind that there are two copyrights in a piece of music: the composition copyright (think notes on paper) and the sound recording copyright (think sounds captured on tape or hard drive). Songwriters often enter agreements with publishers to “grant” their songwriting copyrights in exchange for up-front payment and/or the promise of circulation in the marketplace. Musicians (and bands) transfer their sound recordings to labels for similar reasons, including distribution, promotion and marketing. Authors of both copyrighted works can reclaim the copyrights to their original creations after a period of 35 years. Some of the terminology around copyright can seem confusing at first. Here are few basic definitions.

Why do creators have this right? Section 203 of the Copyright Act permits authors (songwriters and recording artists) to terminate deals that they made transferring or licensing their copyrights after 35 years. Meaning, if you transferred your recording or song to a record label or publisher at the beginning of your career or licensed certain rights, you may be eligible to regain ownership or terminate the licenses after this period. Artists may have more leverage than they did at the time that they signed away their copyright(s), and using this leverage, artists could re-grant their copyrights in a better deal or recapture ownership for the purpose of licensing directly. Complicating factors Although crafted in 1976, the current version of the Copyright Act was not put into effect until 1978. This means that the first grants of transfer eligible for termination under the updated law are grants that were executed on or after January 1, 1978. This guide will focus solely on works eligible for termination under Section 203 of the Copyright Act. This Guide is not legal advice. Since the process can be convoluted and to some extent uncertain, we strongly suggest that those seeking to undertake a termination seek formal legal advice from an attorney experienced in these matters. What can be terminated? However, there are a couple of exceptions: • Works for hire. You, as an employee, make a musical work within the scope of your employment, or by an independent contractor, as a specially ordered or commissioned work for use as a contribution to a collective work or as a compilation or as part of an audiovisual work. Who Can Terminate?

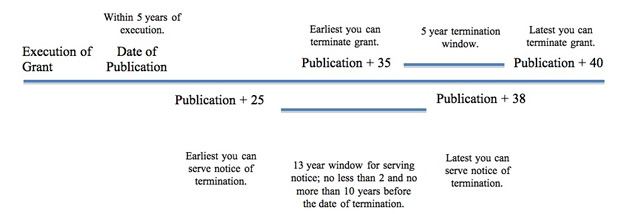

As you can see, calculating who has the power to terminate gets tricky in a hurry. Remember, the chart above speaks in general terms. If you want to pursue your termination right, it is advisable to contact a lawyer. The termination process Notice The notice must be in writing and include: • The date that termination will be effective. Well, that is a lot of info, and some of it may not be easy to gather. The regulations do say that you can include a statementexplaining that you have provided as much information as is currently available to the individuals who are signing the notice and an explanation of why full information is not available. The regulations also explain that all information should be contained in the notice and not reference other documents. Small errors are OK, but if you have something wrong thatmaterially affects the adequacy of the information in the notice than you won’t be able to terminate. In other words be careful, and consult an experienced attorney. Who gets sent the notice? If there is no reason to believe that your copyrights — or portions thereof — have been transferred to new parties, then you can simply serve notice to the person/entity to whom you originally granted your copyright(s). If there is reason to believethat such rights have been transferred, then an investigation is necessary and may include: a search of the records in the Copyright Office and, for musical compositions, a report from relevant performing rights societies. Either way, when you find out who needs to be served, you can either provide personal service of the notice or send it by first-class mail to what reasonable investigation shows is their last known address. After you properly serve the individuals whose rights you are terminating, you must record the notice with the Copyright Office. You do this by submitting an exact copy of the original notice, accompanied by a small “recordation fee” and a statement explaining the manner in which notice was served and its date. You must record the notice in the Copyright Office before the date of termination specified on the notice. When can notice be served? The reason for this is that the guidelines surrounding when you can serve notice have to do with the date of termination that you specify in your notice. You have a five-year window to terminate and you can pick any day within that period to do so. However, once you pick a date and write it on the notice you have to serve that notice somewhere in-between 10 to 2 years prior to the date you picked. If you choose a date early in the five-year window and for one reason or another can’t meet the timeline for serving notice, you can always try again by crafting a new notice with a new date of termination (within the five-year window, that is). For grants of right by the author (and only the author), for all the exclusive rights granted by copyright except publication.

If the grant includes the right of publication (i.e., the right to distribute copies for sale), the grant may be terminated during the 5-year period beginning the earlierof 35 years after publication or 40 years after the execution of the grant. Therefore, if publication takes place within five years of when you granted your copyright, the grant may be terminated in the five year period from 35 years to 40 years after the date of publication, as opposed to 35 years after the grant, and notice may be served during the 13 year window from 25 years to 38 years after the date of publication. On the other hand, if publication takes place more than five years after the execution of grant, the grant may be terminated in the five-year period beginning 40 years after the grant, and notice can be served during the 13-year window from 30 years to 43 years after the execution of the grant. This may sound confusing, which is why you should consult a lawyer with expertise in copyright issues. For grants of right for the right of publication.

Conclusion We recognize that this process is complicated, requires specific information, some investigatory work and a strict adherence to dates. It may also be the case that those to whom you granted the use of your copyrights aren’t in a hurry to return them. But remember, this is your right! We hope this guide proves helpful, but it should not act as a substitute for legal advice and guidance. Artists should consult a lawyer if they wish to terminate their copyright transfers/licenses. In addition, this paper only discusses terminations under Section 203 of the U.S. Copyright Act, which only applies to works created on or after January 1, 1978. If the work is considered a work made for hire, the creator cannot terminate the transfer of the work. There is currently disagreement over whether most sound recordings can be works made for hire. If a right to a work created after January 1, 1978 was transferred prior to that date (and prior to its creation), under the Copyright Office’s interpretation of the law, that transfer is not executed until after the work is actually created (or “fixed in a tangible medium of expression”). Therefore those transfers are still ruled by §203. For more on these “Gap Works” See:http://futureofmusic.org/blog/2011/06/23/termination-salvation.

Songwriter Royalty Rates Determined Sound Recording Preservation Reauthorized NEW TAX LAW REGARDING AMORTIZATION OF MUSICAL COMPOSITIONS New Tax Law Favors Songwriters The Tax Reconciliation Act of 2005, a vehicle that contains the "Songwriters Capital Gains Tax Equity Act." took effect on January 1, 2007. This legislation was envisioned by the Nashville Songwriters Association International (NSAI) to benefit American songwriters who sell a song catalogue. Previously, when songwriters sold a "catalogue" they paid ordinary income taxes AND self-employment taxes that could amount to more than 40% of their income from the sale. Now they will be elegible for the flat 15% "Capital Gains" business tax rate, just like their joint-venture music publisher partners. The legislation applies only when a songwriter sells the royalty stream on a group of songs ("song catalogue"), and will not apply to ordinary royalty income. "This is a simple matter of fairness, and is a landmark moment for the American songwriting profession," said NSAI Executive Director Barton Herbison. "Not only do songwriters deserve this tax treatment, but with the decimation of this profession over the past decade, we might actually save the careers of some very talented songwriters." Decades ago the tax category in which songwriters pay taxes was changed, and they should have become immediately eligible for this tax treatment. Through an oversight, the language in the U.S. Tax Code that would have permitted the appropriate tax rate never evolved. NSAI learned of the situation five years ago and immediately began crafting the legislation to accomplish this "technical correction" to the tax code. "I want to give a special thanks to everyone who helped on this legislation," said NSAI President Bob Regan. The "Songwriters Capital Gains Tax Equity Act" was introduced by Representative Rono Lewis (R_KY) and John Tanner (D-TN), who are members of the House Ways and Means Committee, and Senator Jim Bunning (R-KY), a member of the Senate Finance Committee. "These sponsors deserve special praise because they worked on this issue for five years. They understood the unfairness of our situation and responded," Regan continued. Regan thanked Senate Majority Leader Bill Frist for emphasizing the need for the legislation, and guiding it through the "Conference" process. Frish personally called the NSAI Board of Directors during their May 9th meeting to tell them that adoption of the legislation appeared imminent. Regan also thanked the entire Tennessee Congressional delegation for co-sponsoring the bill. "I would like to send particular thanks to Tennessee Congresswoman Marsha Blackburn," Regan continued. "She took an extremely personal interest in this legislation and opened many, many doors that would have otherwise been shut, and personally solicited co-sponsors for the bill. I cannot overemphasize how integral she was in the passage of this legislation." "Throughout the legislative process we have viewed this change as more of a 'technical correction' than some new philosophical approach to the U.S. Tax Code," Herbison said. "There is a long history behind this issue and it is something that songwriters clearly deserve. The songwriter-music publisher, joint-venture business partnership is the only one we can find where two equal business partners pay different tax rates." "The average songwriter's annual income is only $4,700," Herbison continued. "I expect many songwriters to take advantage of this new tax rate to literally continue to exist in this industry during these touch times." Herbison added that America has lost more than half of its songwriters over the past decade due to Internet piracy, corporate mergers and de-regulation of radio. "I don't expect songwriters will rush to sell song catalogues," Herbison said. "Instead, they use their catalogues as equity at the bank. I do expect songwriters to borrow against their catalogues to pay the bills. Hopefully, this legislation can help put some songwriters's child through college." The Nashville Songwriters Association International, established in 1967 and with more than 100 chapters around the country, is the world's largest not-for-profit songwriter's trade organization dedicated to serving songwriters of all genres of music.

|

||||||||||||||||||

Home | About Us & Our Clients | Calendar & Special Events | Best Picks & Best Links

Useful Forms & Important Issues | Contact Us